GET READY FOR YOUR BEST CAREER CHOICE YET

GET READY FOR

YOUR BEST CAREER

CHOICE YET

WHY JOIN THE 75 FOR ALL MOVEMENT?

BE MORE

WITH A 50-STATE OPPORTUNITY AND THE INDUSTRY’S TOP TECHNOLOGY,

YOU CAN GET MORE OF WHAT YOU WANT OUT OF LIFE.

DO MORE

WITH BEST-IN-CLASS COACHING AND INDUSTRY-LEADING MARKETING, YOU CAN HELP MORE POTENTIAL HOMEBUYERS.

HAVE MORE

WITH A WIDE VARIETY OF LOAN PRODUCTS FROM OUR FELLOWSHIP FINANCIAL INSTITUTIONS,

YOU CAN ACHIEVE YOUR GOALS.

BE MORE

WITH THE ABILITY TO ORIGINATE IN ALL 50 STATES

You might be familiar with traditional steps to becoming a Mortgage Loan Officer. Through our nationwide initiative with a federally-chartered credit union, we can offer you a better way.

TRADITIONAL

ROUTE

- Complete Pre-License Course

- Pass Licensing Exam (close to 50% Failure Rate)

- Complete Annual Renewal & Continuing Education

- Repeat for Each Additional State

- Minimum Credit Scores can Apply

BETTER

ROUTE

- Sign Up

- Background Check

- Originate in All 50 States

TRADITIONAL

ROUTE

-

Complete Pre-License Course

-

Pass Licensing Exam (close to 50% Failure Rate)

-

Complete Annual Renewal & Continuing Education

-

Repeat for Each Additional State

-

Minimum Credit Scores can Apply

BETTER

ROUTE

-

Sign Up

-

Background Check

-

Originate in All 50 States

Let’s face it. Licensing and renewals require a lot of time. Through our movement, what you don’t have to do leaves you time to do what you want.

No State Licensing Tests

No State Licensing Fees

No Continuing Education Requirements

No Annual Renewal

No Annual Renewal Fees

CONVERT MORE LEADS WITH THE

INDUSTRY'S TOP TECHNOLOGY

INCREASE PRODUCTIVITY AND BE MORE EFFICIENT

Integrate and multiply your efforts using our CRM, LOS, POS and our industry-leading content.

Market consistently across multiple channels including email, text, print and more.

Deliver the right message through the right channel at the right time based on real-time insights, events, transactions and data.

DO MORE

GET THE HELP OF OTHER LOAN OFFICERS, AKA LOAN BUDDIES,

IF YOU NEED IT WITHOUT WAITING FOR LICENSING

Investors, entrepreneurs, real estate agents and anyone else who wants to make an impact can become a loan officer.

What if you could help your tenants buy and earn MLO commissions on your sales?

Government-sponsored mortgages: FHA, VA, USDA, as well as Fannie Mae and Freddie Mac

FHA mortgages with credit scores as low as 580

Manual underwriting on applications rejected by automated underwriting

What if you could originate loans but didn’t need to worry about all the details?

GET HELP FROM A LOAN BUDDY

– skilled MLO at HQ – to close loans:

LOAN OFFICER

- Help the homebuyer complete application

- Help gather documents from the homebuyer

- Answer homebuyer questions about loan programs.

LOAN BUDDY

- Work with loan applications and help the Loan Officer through the process

- Answer questions and keep the Loan Officer updated on loan status

- Provide answers to any Loan Officer questions about the different types of loans available

- Use underwriting software to review loan applications

- Finalize and submit loans

LOAN OFFICER

- Help the homebuyer complete application

- Help gather documents from the homebuyer

- Answer homebuyer questions about loan programs.

LOAN BUDDY

- Work with loan applications and help the Loan Officer through the process

- Answer questions and keep the Loan Officer updated on loan status

- Provide answers to any Loan Officer questions about the different types of loans available

- Use underwriting software to review loan applications

- Finalize and submit loans

HAVE MORE

WITH A WIDE VARIETY OF LOAN PRODUCTS, COACHING, AND TOOLS TO

BUILD YOUR BUSINESS AND DO RIGHT BY YOUR RELATIONSHIPS

What if you could offer your tenants solutions tohelp them get mortgage ready?

CREDIT ISSUES?

We can provide attorney assisted credit restoration

NO DOWNPAYMENT?

Down Payment Assistance

INSUFFICIENT INCOME DOCUMENTATION?

We make introductions with tax preparers to help properly document self-employment and gig income.

What if the excitement your client is feeling about buying a home doesn't result in being approved?

NO ONE WANTS THE UNCOMFORTABLE FEELING OF SENDING A CLIENT AWAY AFTER A LENDER REJECTS THEIR APPLICATION. INSTEAD, CONVERT LEADS THAT DON’T CURRENTLY QUALIFY FOR A MORTGAGE INTO SALES IN THE FUTURE BY REFERRING TO OUR LEGAL PLAN.

THROUGH OUR LEGAL PLAN, YOUR CLIENTS CAN DISPUTE DEBT AND CREDIT REPORT INACCURACIES AND YOU CAN CREATE A POSITIVE RELATIONSHIP THAT BUILDS TRUST AND LEADS TO BUSINESS IN THE FUTURE.

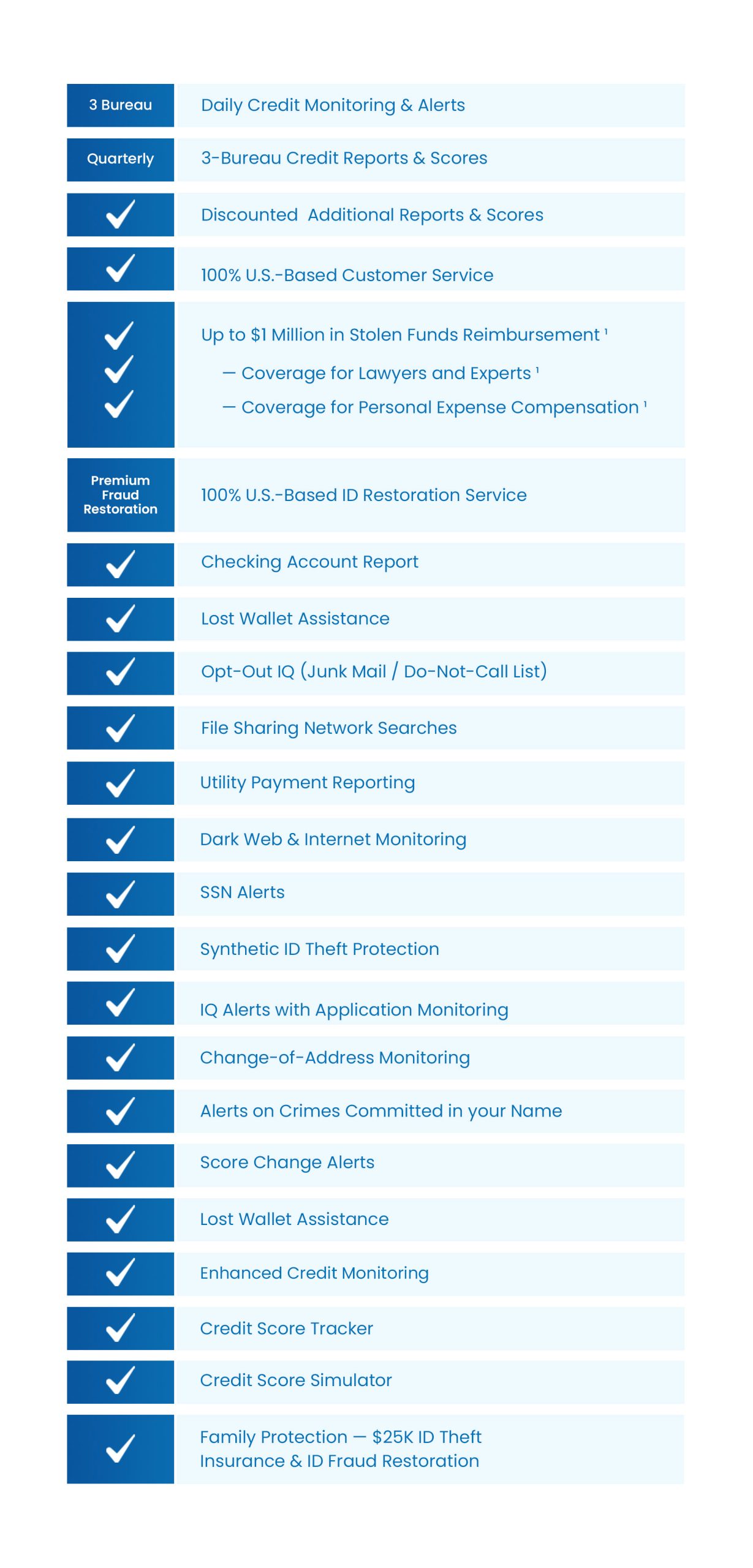

SCORE PATH

IdentityIQ 24-hour automated credit monitoring service offers you continuous protection, so you can be sure your identity remains under you.

Utility Reporting – Report your utility payments to the credit bureaus to improve your credit score.

Rental Kharma – Add your rental payment history at your current rental address to your TransUnion and Equifax credit reports.

Credit Builder Card – Build up a credit history from scratch or get your credit rating back on track after being refused credit.

CASH PATH

Defend yourself against creditor aggression and keep more of your hard-earned money

— Plan Attorney coordinated defense against creditor harassment

— Plan Attorney quarterbacked FCRA claim review

— Help with creditor lawsuits

Student Debt Solutions – Debt Cleanse has partnered with Student Debt Solutions to offer Members services related to their student loans!

LIFE PATH

Equip yourself with knowledge and

tools to minimize financial risk

— Auto-track income and expenses with AI-based automation

— Easily create your personalized budget and goals

— Stay on track every day, week and month.

Student Debt Solutions – Debt Cleanse has partnered with Student Debt Solutions to offer Members services related to their student loans!

HOMEOWNER PATH

Start-to-finish help with the home buying process.

AHP Mortgage Direct $500 Closing Cost Credit

WEALTH PATH

Develop and implement and individualized

wealth realization plan.

— Note Investment Training

— Discounted Non-Performing Mortgage Investment Education

WHAT WE

OFFER

Residents and community groups know best what will make their neighborhoods thrive. The ideas and vision are there, but too often, what's missing is the capital to get these projects realized. That’s where our fellowship financial institutions come in, with a mortgage product for almost every situation and buyer.

FHA

VA

USDA

FANNIE MAE

FREDDIE MAC

RENOVATION

RENTAL PROPERTY

ITIN MORTGAGES

CONDO

BUILDER

SUCCEED. CELEBRATE. REPEAT.

Get the coaching and tools that will accelerate your success.

Not only can a Loan Buddy coach you, learn from the best through live business skill development seminars. Top producers share practical ideas to grow your business. Plus, you’ll have someone alongside you to clarify your vision, provide best-in-class coaching and hold you accountable for the goals you’ve set for yourself and celebrate with you when you accomplish them.

MORE

OPPORTUNITY

Commission per Transaction

On the first 30 transactions, a 15-30% commission share with Loan Buddy may apply.

Commission Match of Personal Recruits

In addition to your personal transactions, you also make 10% on all the closed transaction of your personal recruits.

Share in Keller-Williams type of Bonus Pool

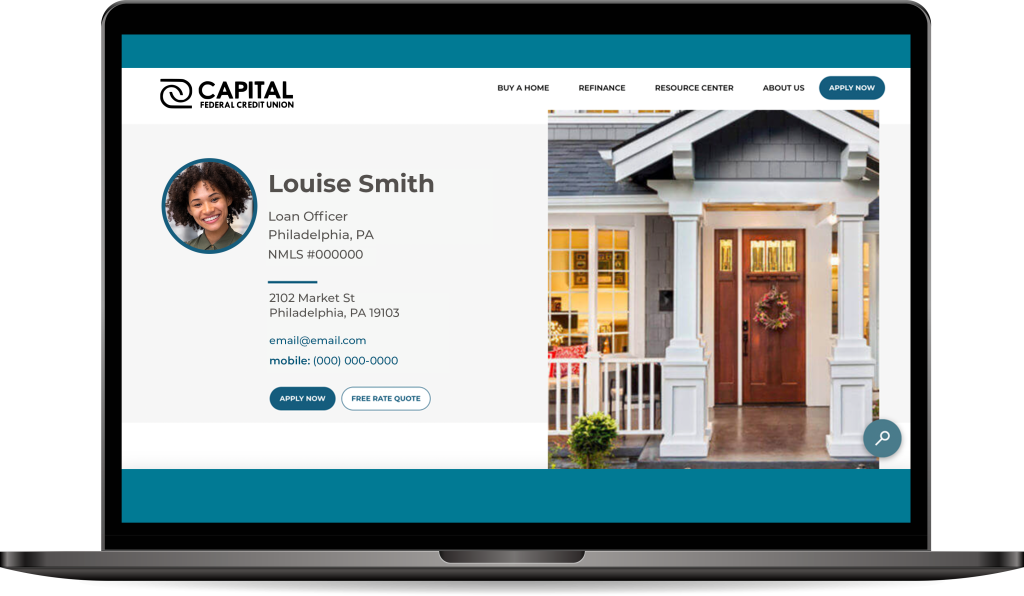

Also, your personal website, sponsored by our fellowship financial institution, and optional business cards for purchase can help create more connections. You can even qualify for a Zillow personal website and leads!

Recruiting income and smart tools can help maximize your experience and income as a MLO. Don’t be surprised if people you know take note of your success and decide to join you in the 75 For All movement.

TAKE YOUR CAREER

TO THE NEXT LEVEL

Increase homeownership rate to 75% for all

- info@debtcleanse.com

- 800-500-0908

- 900 S Pine Island Rd Suite 205, Plantation, FL 33324, United States

Subscribe to our Newsletter

Subscribe to 75 for All newsletter to receive our latest blog posts, free resources and tips.

Subscribe to our Newsletter

Subscribe to 75 for All newsletter to receive our

latest blog posts, free resources and tips.

- info@debtcleanse.com

- 800-500-0908

- 900 S Pine Island Rd Suite 205, Plantation, FL 33324, United States